What Is ARR: Calculation & Common Mistakes

The estimated life of the machine is of 15 years, and it shall have a $500,000 salvage value. The churn rate, the percentage of customers who stop using your product or service each month, heavily influences your Annual Recurring Revenue (ARR). When calculating ARR with monthly churn, it’s vital to consider the number of customers lost each month. Mistakes in ARR calculation often involve misinterpretation of revenue and overlooking churn rate. The upcoming sections will help you understand these common errors and offer guidance on how to sidestep them.

Step 1 of 3

Each metric brings its own benefits and drawbacks, contingent on the business scenario or context. More specifically, ARR shows the recurring revenue component of a company’s total revenue, signaling the long-term sustainability of a SaaS company’s business model. As ARR represents the revenue expected to repeat in the future, it’s most useful for observing trends, forecasting growth, and recognizing your company’s strong or weak points.

How to calculate Accounting Rate of Return in Excel?

A common mistake often made is the inclusion of one-time or variable fees in the ARR calculation. It is crucial to understand that the ARR calculation should only consider recurring revenue. If these fees are included, it can lead to misinterpretation as ARR is distinct from annual revenue and contract value. For SaaS businesses, accurate calculation of ARR holds significant importance. However, the lack of a standard method often leads to confusion during this process. For example, some businesses might consider only the subscription revenue from active customers in ARR, while others might start counting the moment a contract is signed.

What Is the Accounting Rate of Return Useful For?

The annual recurring revenue (ARR) metric is a SaaS or subscription-based company’s total recurring revenue, expressed on an annualized basis. In the United States, the Accounting Standards Codification (ASC) Topic 606 defines how to recognize revenue from customer contracts according to the Generally Accepted Accounting Principles (GAAP). This process, consisting of five steps, evaluates the expected collection amounts and the nature of the goods/services transferred to the customer. However, ARR, a non-GAAP metric, does not adhere to the same specific classification rules as GAAP revenue recognition. While GAAP revenue recognition uses historical data, ARR projects future revenues. GAAP revenue recognition appears on a company’s GAAP financial statements, whereas ARR typically shows in management reporting and the Management Discussion and Analysis (MD&A) section of financial reports.

If you’re making a long-term investment in an asset or project, it’s important to keep a close eye on your plans and budgets. Find out everything you need to know about the Accounting Rate of Return formula and how to calculate ARR, right here. The accounting rate of return (ARR) is an indicator of the performance or profitability of an investment. Below is the estimated cost of the project, along with revenue and annual expenses. The accounting rate of return is a simple calculation that does not require complex math and allows managers to compare ARR to the desired minimum required return.

Example: simple rate of return method with salvage value

In this blog, we delve into the intricacies of ARR using examples, understand the key components of the ARR formula, investigate its pros and cons, and highlight its importance in financial decision-making. Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. The new ARR will be hard coded for January and February, and then the beginning ARR will be multiplied by the respective churn rate and upsell assumptions.

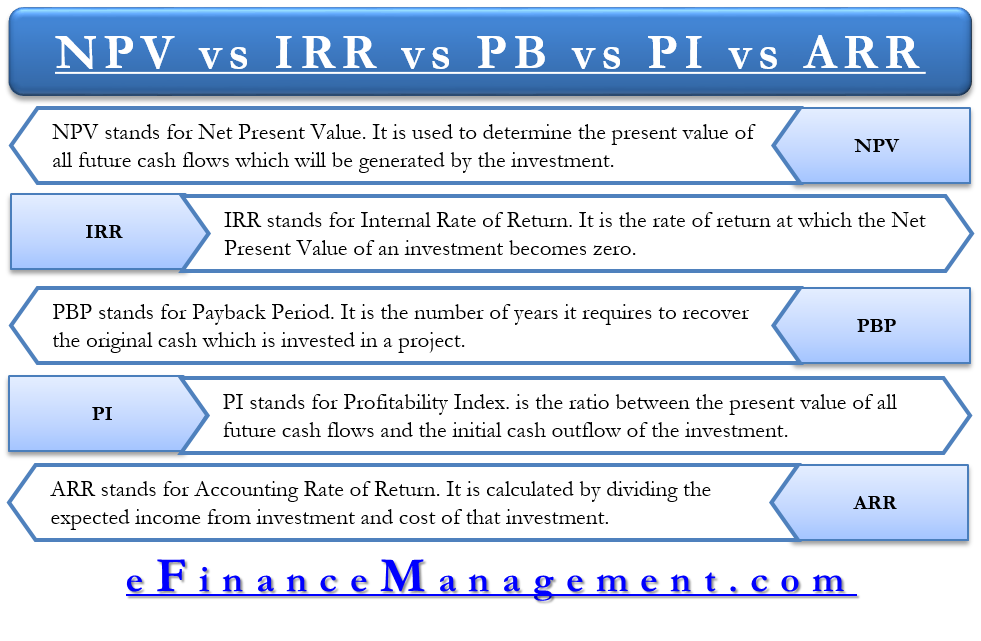

Another variation of ARR formula uses initial investment instead of average investment. The accounting rate of return is a capital budgeting indicator that may be used to swiftly and easily determine the profitability of a project. Businesses generally utilize ARR to compare several projects and ascertain the expected rate of return for each one. You have understood the importance of ARR as a crucial measure for the financial health of your Software as a service business. You have learned the accurate method of calculating ARR, from identifying recurring revenue to including discounts and churn rate.

- Accounting Rate of Return formula is used in capital budgeting projects and can be used to filter out when there are multiple projects, and only one or a few can be selected.

- The ARR metric factors in the revenue from subscriptions and expansion revenue (e.g. upgrades), as well as the deductions related to canceled subscriptions and account downgrades.

- Get granular visibility into your accounting process to take full control all the way from transaction recording to financial reporting.

- Annual Recurring Revenue (ARR) estimates the predictable revenue generated per year by a SaaS company from customers on either a subscription plan or a multi-year contract.

In terms we often use in non-standard accounting, Annual Recurring Revenue (ARR) helps us understand the steady and ongoing income parts of subscription-based businesses. This metric, which doesn’t get the green light from Generally Accepted Accounting Principles (GAAP), looks at the total income at a single moment. Instead, investors use ARR xero shoes terraflex review for evaluations outside GAAP’s scope, such as forecasting budgets or building financial models. It’s important to keep in mind that while ARR serves as a helpful tool to gauge a company’s performance, it shouldn’t be the sole metric. It should act as one piece of the puzzle for a comprehensive understanding of the company’s financial health.